How Much Money Will My Roth Ira Be Worth

Roth IRA Estimator

If you're ready to maximize your retirement savings with the revenue enhancement-free growth that a Roth IRA can provide, enter your data into our calculator to go an estimation for what your IRA will be worth at retirement.

- Updated: Nov v, 2021

- This page features 7 Cited Research Articles

An private retirement account (IRA) is an investment account that tin can help yous build your retirement savings. A Roth IRA in particular allows your money to grow revenue enhancement-gratuitous, which can be extremely beneficial for retirement savings if you lot maximize contributions each year.

Apply the Roth IRA computer below to sympathise your potential earnings — and revenue enhancement savings — from contributing to this blazon of account.

Tip

Pull your electric current Roth IRA balance and the previous year'southward tax return to get the most accurate Roth IRA calculation.

Boilerplate Rate of Return on a Roth IRA

If y'all invest in specific stocks or mutual funds that follow the stock market, you tin can expect a 7 to ten percent return, equally historical data has shown. Co-ordinate to data from Goldman Sachs and South&P Global, the stock marketplace has averaged a render of 9.2 percent over the last 140 years.

A Roth IRA is not an investment in and of itself. Instead, it'southward an business relationship you lot keep your other investments in. With this in mind, it'southward important to annotation that your Roth IRA itself will non earn you returns, but rather the individual investments in your business relationship.

While 9.2 percent may exist the long-term average, returns tin vary from year to year. However, this is a practiced criterion when looking at long-term gains from stock market investments. You tin can also cull to invest Roth IRA contributions to bonds or certificates of eolith, all of which will offer different potential returns.

Roth IRA Calculator FAQ

If you're considering contributing to a Roth IRA, yous probable take many questions. Expect through some of the most normally asked questions below or talk with a financial advisor or planner if your questions aren't addressed here.

- How much can I put in a Roth IRA each year?

- According to the IRS, the contribution limit in 2021 is $6,000 per twelvemonth, or $500 per month. If you're l or older, the maximum contribution is $7,000.

- How much should I put into my Roth IRA?

- To set bated enough coin for a comfy retirement, the recommended contribution corporeality is the maximum amount allowed by the IRS. The exact amount each individual should contribute varies depending on their financial state of affairs and desired retirement lifestyle.

- Tin can you lose money in a Roth IRA?

- Yes, it's possible to lose money in a Roth IRA. Most losses are dependent on market fluctuations, still, you can also lose money from early on withdrawal penalties.

- What is the five-year dominion for a Roth IRA?

- There are several different v-year rules. The most common refers to the five-twelvemonth waiting menstruation required before withdrawing funds from your Roth IRA.

- Do I have to report my Roth IRA on my taxation return?

- Unlike contributions to a traditional IRA, the IRS has stated that yous don't need to report Roth IRA contributions on taxation returns.

- Tin can married couples have two Roth IRAs?

- Married couples, like unmarried filers, can have multiple IRAs. However, each individual can only have one Roth IRA in their proper name, and joint accounts aren't permitted. Each spouse can contribute to their own business relationship, or ane spouse tin contribute to both.

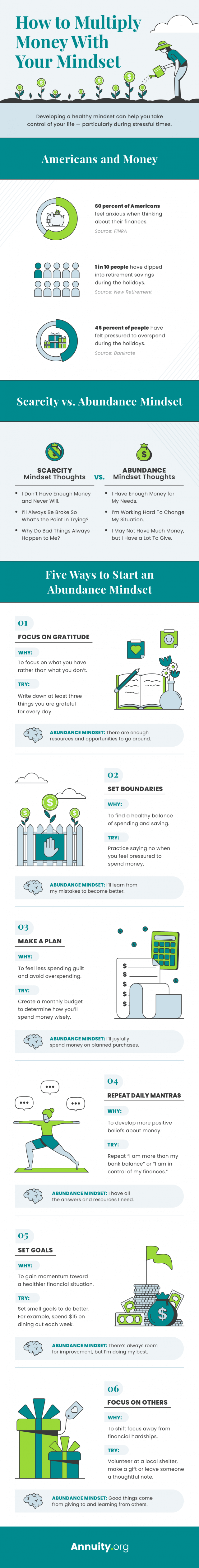

Keeping a Salubrious Money Mindset When Saving for Retirement

Saving for retirement tin be stressful, overwhelming and a petty scary if you don't take help along the way. Talking with a financial advisor or two can assistance you overcome these negative feelings, merely learning how to view money differently can ultimately help you thrive before and after you lot retire, regardless of your circumstances.

No matter what retirement accounts yous choose to invest your money in, don't let a negative mindset dictate how much you set aside each month. Instead, make a retirement programme that will help yous achieve your desired lifestyle and take some of the stress off of saving for your after years.

Having a program for your retirement savings can reduce stress particularly during meaning life changes or seasons where spending is loftier, like the holidays. Look through the visual below to empathise how to build a healthier money mindset.

Planning for Retirement With a Financial Advisor

Understanding the benefits of unlike retirement accounts tin can assistance y'all see which will be the best option for you. While this Roth IRA calculator predicts potential returns and benefits, it'southward e'er all-time to consult a financial professional when making decisions that can impact your money and your future.

Experts in the financial field can guide you through the process of choosing an investment business relationship. They can also help you find the best fashion to withdraw your funds afterwards — exist information technology through purchasing an annuity, withdrawing certain percentages each month or through another method.

Delight seek the communication of a qualified professional before making financial decisions.

Concluding Modified: November five, 2021

7 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and apply merely credible sources of information, including authoritative financial publications, bookish organizations, peer-reviewed journals, highly regarded nonprofit organizations, authorities reports, court records and interviews with qualified experts. You can read more well-nigh our commitment to accuracy, fairness and transparency in our editorial guidelines.

- Coxwell, K. (2015, December xvi). Christmas or Retirement? Put Your Holiday Spending in Perspective. Retrieved from: https://www.newretirement.com/retirement/christmas-or-retirement-put-your-holiday-spending-in-perspective/

- Dinkytown.net Financial Calculators. (north.d.) Roth IRA Computer. Retrieved from: https://world wide web.dinkytown.net/coffee/roth-ira-estimator.html

- Garcia, A. (2018, November 19). Gift-giving guilt: Well-nigh one-half of Americans take felt pressured to overspend during the holidays. Retrieved from: (https://world wide web.bankrate.com/personal-finance/holiday-gifting-survey-nov-2018/

- IRS.gov. (2021, August 18). Retirement Topics - IRA Contribution Limits. Retrieved from: https://world wide web.irs.gov/retirement-plans/programme-participant-employee/retirement-topics-ira-contribution-limits

- IRS.gov. (2021, September thirty). Retirement Topics - Exceptions to Tax on Early on Distributions. Retrieved from: https://www.irs.gov/retirement-plans/programme-participant-employee/retirement-topics-tax-on-early-distributions

- Lin, J. et al (2019, June). The State of U.S. Financial Capability: The 2018 National Financial Capability Study. Retrieved from: https://www.usfinancialcapability.org/downloads/NFCS_2018_Report_Natl_Findings.pdf

- Scheid, B. (2020, July 15). S&P 500 returns to halve in coming decade – Goldman Sachs. Retrieved from: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/due south-p-500-returns-to-halve-in-coming-decade-8211-goldman-sachs-59439981

Source: https://www.annuity.org/retirement/ira/roth-ira-calculator/

Posted by: samonscancest.blogspot.com

0 Response to "How Much Money Will My Roth Ira Be Worth"

Post a Comment